If you cannot picture the forest, you have to take a photo of every tree!

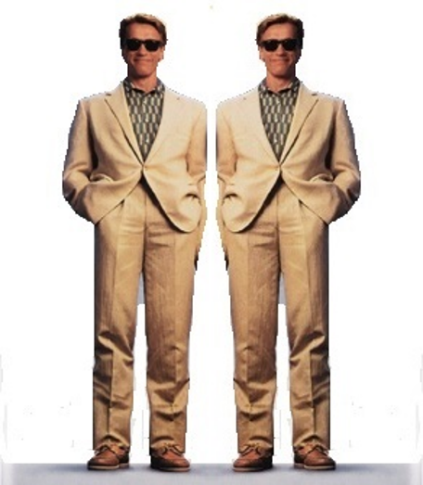

Years back a new Financial Officer was recruited within our Management Team. The new man had an excellent track record, amongst others had he earned his reputation at one of the larger International Audit Firms. At first glance he and the CEO (Chief Executive officer) looked very similar. Next to their shared affinity for numbers, they had similar dress codes, habits, humor and hobbies. Like twins, ‘only their mother could tell them apart’.

Much to my surprise, it very rapidly became clear that they were in fact almost each other’s opposites and their relationship deteriorated at great speed. I once witnessed a very agitated discussion between the two, whereby the CFO kept on stressing that the valuation of the stocks was not fully correct and the CEO cried out: “Even if the stocks would be valuated wrongly three times over, it would not have any significant effect on our financial result.”

Due to this discussion it became clear to me what the root cause was of their difference and the confusion between the two of them. Let me take you on a journey through the world of financial ledgers, Financial Accounting and Management Accounting.

The beauty of a worldwide standardized accounting system

The beauty of the financial accounting system is that she is universal. That’s why any accountant can audit any financial ledger. It is based on the capability to value non-financial topics like inventory, machines, stocks and bonds (financial assets) and yes even brands or reputation (financial goodwill) and translate that into money. Now that everything is converted into money we can apply arithmetic, compute and compare. This is an extremely powerful capability, but at the same time sometimes very dangerous.

There are two totally different functions that are both working with the financial ledgers, however they both require totally different types of people.

Financial Accounting and Management Accounting two worlds

Financial Accounting is what we traditionally call ‘bookkeeping’. I prefer to call it the ‘administrative factory’; involved in the processing of invoices, payments and receipts, the registration and depreciation of assets, the settlement of tax, and so on. The administrative factory inhabits the so-called white collar workers, who execute the financial functions that are related to the primary process of any company. The main task of Financial Accountants is to be as precise as possible.

The question whether a price on the invoice is too high for the products or services rendered, or whether the inventory goes through the roof and ties up most of our money, is not relevant here. The main question is whether it has been entered correctly into our financial ledgers.

Any financial outsider is at first astonished that if a wrong invoice arrives at the Finance Department it is just being entered into their Financial Ledgers. If an invoice contains a price that is ten times too high, an obvious typo error, whereby € 1.000,- became € 10.000, the bookkeeper straight away enters the invoice for € 10.000,- and starts making phone calls to demand a credit note of € 9.000,-.

Truth, verification and traceability is the thing!

Management Accounting is more looking from a managerial or industrial engineering focus to ‘how well do we do what we do’ with the financial ledgers as the most important toolbox at hand. This assumes knowledge of both the actual processes and of the principles of the financial bookkeeping and ledgers. Here questions are asked like: is this investment sound, how profitable are our products, are the labor cost not running out of hand and so on. Here it is not so important that all numbers add up to a certain number of decimals. The main question here is how fast we can get sufficiently right information to base a proper decision on. In the field of Management Accounting it is sometimes even better to use numbers from another source as indicator or estimation of what we are looking for (for example ‘tons output’ x ‘average cost price’ instead of turnover). Here the following saying applies: “It is better to be roughly right than precisely wrong.” This requires a different type of person, with a different view and attitude. Investors, private equity firms and the like are in demand for this type of accountants.

Two accountants, ‘only their mother could tell them apart’

Both areas require a totally different outlook, attitude and mentality. Where the Management Accountant looks at what has roughly the greatest impact on our financial results or other management questions, the Financial Accountant’s main focus is whether it has been registered correctly.

The agitated discussion at the beginning of this article clearly illustrated this difference. Two apparently identical types, turn out to be miles apart from each other. It is like the film Twins, whereby Arnold Schwarzenegger and Danny DeVito are twins . . . . . . ‘only their mother could tell them apart’.

Different functions require a different career pattern

In the old days, a classic career starts after a financial education at the finance department working your way through Accounts Payable, Accounts Receivable, Asset Management, Treasury, to make the step from Financial Accounting into Management Accounting to hopefully end at the position of Financial Controller or Financial Director (‘stairway to heaven’).

Until the step towards Management Accounting, almost all work could be executed without the need to really understand or grasp the actual processes that take place in the company. For many people, this career move entails to actually descend from heaven into the stubborn reality where gravity still rules. However both, the person making the step and his environment, do not realize that until then the person has only followed all the processes on an abstract level.

Mistakenly, we all expect that such a person should be able to easily cope with Management Accounting, since “he has been at this company for quite a while now”.

Experience tells us that the step towards Management Accounting is far more difficult for a Financial Accountant than, for example, an Industrial Engineer. It makes sense that it is easier to translate one’s process knowledge into a financial figure, than to deduce from a financial figure what process it might entail. The sheer power of the financial administration, that one can do the bookkeeping with little to no knowledge of the real factory and its processes and being able to keep the administrative factory going, has now become a disadvantage. Both the person involved and the organization think that if you work for such a time for the company you will have automatically obtained that process knowledge already.

The key is to distinguish the relevant forest

If you do not really grasp a process it becomes very difficult for the Management Accountant or Financial Controller to determine how and on what level of detail they can follow the process from a financial perspective best.

If you analyze a process, you will find in most cases a more or less obvious optimum as to how you can best estimate, budget, plan, monitor and evaluate it.

It is evident that it is not sufficient to monitor the progress of all of your investments just once a year and equally evident that you will not, cannot and should not do it every day. Likewise you will not assess the whole lot as one, nor will you want to assess every single, small investment that is made. The optimum should be somewhere in between. There are certain levels of aggregation in terms of size, throughput time, subject, interconnection, complexity, risk, time bucket and period etc. that provide the best view for the least work. However, to achieve the most suitable information, enabling you to steer it is vital to have a clear understanding of the (specific) process or topic. Content is needed.

If you cannot picture the forest, you have to take a photo of every tree

Lack of specific knowledge about the process often leads to unnecessary and undesirable detailing of information and often the use of dangerous averages. Financial Accountants, by their background and nature, have the tendency to break any subject into too many pieces and to a far too detailed level of information. This leads to more work, less information and more ad-hoc behavior. Unfortunately, if you cannot picture the forest, you have to take a photo of every tree, which is time consuming for all involved in gathering the data and often leads to poorer steering.

To fulfil the Management Accounting role, you should either select a process expert with financial affinity or you should allow sufficient time and training to let the Financial Accountant obtain sufficient process knowledge!

Veghel, augustus 2016